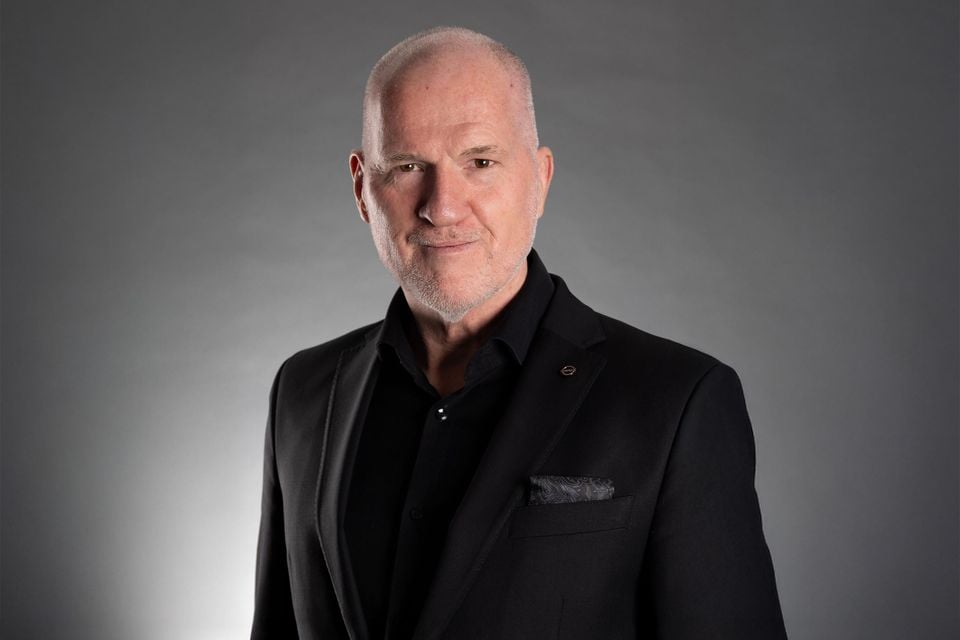

Nissan Oceania may have a brand new boss from April 2026, after Andrew Humberstone was confirmed to be returning to Nissan in Europe after two years within the prime job domestically.

Mr Humberstone, who has been managing director of Nissan Oceania since April 2024, will likely be changed by Steve Milette, efficient April 1, 2026.

Mr Milette is at present Nissan North America’s division vp for vendor community growth, buyer assets, coaching and buyer expertise. He beforehand headed up Nissan’s Canadian division for greater than 5 years.

It’s yet one more management change throughout the Australian automotive business, with new bosses at MG, Mitsubishi, Volkswagen and Ford in 2026.

CarExpert can prevent hundreds on a brand new automotive. Click on right here to get a fantastic deal.

Mr Humberstone’s new function in Europe hasn’t been specified, with an announcement from the corporate saying he’ll take up a “senior function” at Nissan’s regional headquarters in Paris, France.

When Mr Humberstone arrived in Australia in 2024 to steer Nissan’s Oceania operations – which embrace the Dandenong casting plant and the New Zealand enterprise – the model had simply posted 48.6 per cent gross sales progress in 2023, led by robust gross sales of the not too long ago launched X-Path SUV.

The outgoing chief has overseen the rollout of the model’s e-Energy hybrid expertise following its 2022 introduction, in addition to the extension of the native Warrior program for the Navara and Patrol in partnership with Melbourne-based Premcar.

Challenges for Nissan globally, nonetheless, have additionally impacted the model in Australia, with management upheaval abroad coming because the automaker faces important monetary pressures and resultant slower-than-expected product growth.

Nissan’s progress slowed to fifteen per cent in 2024 and, whereas it outperformed the general market’s 0.3 per cent improve, it got here as Toyota set an all-time Australian gross sales file.

In 2025, Nissan Australia posted a 21.6 per cent drop in gross sales and dropped out of the highest 10, ending in twelfth place. The Japanese automaker additionally fell exterior the highest 10 globally to the top of June.

Whereas a facelift of the volume-selling X-Path is due in Australia earlier than April, the current-generation mannequin has been on sale right here for 4 years, as has the smaller Qashqai SUV. Each face rising competitors from more energizing rivals and a rising variety of manufacturers getting into the native market.

The brand new-generation Navara, a rebadged Triton from Alliance associate Mitsubishi, arrives in showrooms early this 12 months. It comes not a second too quickly, given the outgoing technology was outsold final 12 months by not solely established ute nameplates but additionally newer entrants just like the BYD Shark 6 and GWM Cannon.

The Pathfinder SUV was the one Nissan mannequin to file larger gross sales domestically final 12 months (up 40 per cent), although its complete of 732 items was comfortably eclipsed by different massive SUVs together with the discontinued Mitsubishi Pajero Sport.

Nissan Australia belatedly launched the Ariya electrical SUV domestically final 12 months, with Mr Humberstone admitting its launch was pressured by the New Car Effectivity Normal (NVES) rules that got here into impact on January 1, 2025.

The Ariya’s repeatedly delayed arrival got here nearly three years after its US-market launch, with the mannequin coincidentally dropped from the US lineup inside days of its Australian debut because it confronted headwinds in that market.

In 2026, alongside the facelifted X-Path, Nissan is about to launch an up to date Qashqai e-Energy, however the axing of purely petrol-powered variations of the small SUV has resulted in a base value greater than $10,000 larger than earlier than.

Nissan may even add the new-generation Leaf electrical car (EV) later this 12 months, in addition to the Y63 Patrol SUV which has been on sale in different markets since late 2024.

Alliance companions Renault and Mitsubishi are additionally dealing with native challenges, with Renault posting a 17.8 per cent year-on-year gross sales decline and Mitsubishi recording a 17.9 per cent fall in 2025.